A Look at Bain & Company’s Global Private Equity Report 2023:

How To Take Advantage of Investment Opportunities This Year

One quarter into 2023, and we’re still cursing the ripple effect of inflation that monopolized the conversation in 2022.

February 2023 saw a 6% increase in inflation of consumer prices from one year prior. This persistent inflation was met with attempts to make it stop by the Federal Reserve in raising interest rates by 75 basis points. It was raised not once, but three times last year – a speed not seen since the 1980s.

These increases became fodder for those worried about a recession and deterred banks from providing leveraged loans. The rate rises also posed a problem for happy investors who were taking advantage of the steadily falling interest rates of the previous two decades.

Investments, exits and fundraising all declined in 2022 in the wake of the omnipotent macroeconomic forces. Global buyout value, excluding add-ons, totaled $654 billion, down 35% from 2021. Overall deal count fell 10% to 2,318 transactions. In terms of value, 2022 was still the second-best performance historically, but it’s important to note that’s only due to the incredible momentum of the first half of the year.

This “pause” in deals, exits and fundraising has continued into 2023 and will likely persist until macro factors stabilize. Yet, as we explore in this year’s Global Private Equity Report, opportunity awaits firms that stay aggressive and focus on creating value from the inside out.

Challenges such as natural resource shortages, financial market instability and mounting inflation and recession risks will likely still be seen throughout the first half of 2023, or perhaps even after that.

Inflation hasn’t been this high or persistent in 40 years. Firms can do a lot to mitigate inflation’s impact, but, in many cases, it will come down to the blocking and tackling of taking market share and boosting top-line performance.

In analyzing previous recessions, it’s clear that companies have been able to outperform the competition by investing in R&D and pursuing mergers and acquisitions. Companies that are aggressive in making moves early on rather than retreating in fear are the most successful coming out of a recession.

In 2009, Samsung doubled-down on R&D investment, an area their competitors chose to make cutbacks in. They made a fourfold increase in patents filed in the U.S. and built four types of R&D centers that each had an individual product focus. They also continued to invest in marketing, hiring experienced leaders to help take them to the next level.

This initiative rebranded Samsung as innovative and shook up the market with the release of their first Galaxy smartphone in 2009. At the beginning of that recession, Samsung was ranked No. 21 in brand value among Interbrand’s global list, and now they rank No. 6.

Companies also find success in mergers and acquisitions. A Bain & Company report took data from approximately 24,000 M&A transactions that occurred from 1996 to 2006. They found that acquisitions during 2001 and 2002 produced close to triple the excess returns of deals completed in the years prior to the recession.

Meanwhile PwC’s analysis of acquisitions completed by public companies during the 2001 recession proved the timing of deals to be critical. Deals announced during the first half of the recession produced shareholder returns 10% higher than their respective industries a year on, compared to the average 7% shareholders saw six months after the recession had ended.

Bain & Company’s Sustained Value Creators analysis of 2009 found that of 3,900 companies worldwide, the number of U.S. companies that substantially increased profits was 47% higher during that downturn than during stable periods. And 89% more U.S. companies lost profitability in the last downturn than stable periods.

Private equity returns have come largely from multiple expansion in recent years, rather than from revenue and margin growth. But as higher rates continue to put downward pressure on asset prices, GPs will need to be smart about their approach.

That means returns will increasingly have to come from growth in earnings before interest, taxes, depreciation and amortization (EBITDA).

With private equity rounding out 2022 with a record $3.7 trillion in dry powder, GPs will look to make use of funds as soon as possible. Concerns from buyers, sellers and lenders will be on where GDP is headed and how much further the rate hikes have to go.

According to data from the last downturn, those who came out on top properly assessed their risk scenarios, created mitigation plans and set themselves up to accelerate out of the downturn. Not panicking proved crucial. And understanding that every industry is different.

Some are only affected by a few of the macro factors terrorizing the market.

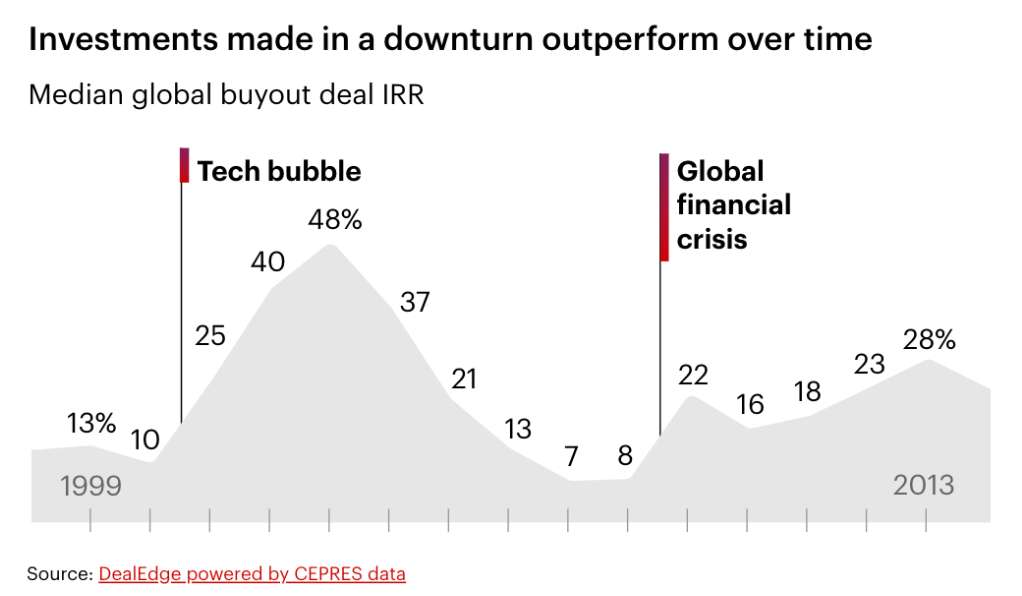

Investments made through a downturn typically generate superior returns over time. In accounting for your particular relevant macro factors and varying scenarios, leaders can confidently find deals.

If you decide to slow down and be conservative, you risk missing out on opportunities that prove to be valuable once the dust settles.

When it comes to strategy for add-ons, GPs and portfolio companies find success in approaching every acquisition with a clear, testable thesis for how the deal will make the platform company more valuable over time.

Value can also be determined by identifying and quantifying synergies, leading to risk mitigation with a comprehensive integration plan to evaluate execution risks early on.

In 2022, add-on acquisitions made up 72% of all North American buyouts by deal count. A growing share of them were used as multiple arbitrage by GPs to buy smaller companies at lower multiples to build one larger company that would command higher valuations.

As GPs look to take advantage of the state of the market and invest, several areas of opportunity present themselves. Artificial intelligence, web3 and big data are on the rise, opening the door for private capital to grow exponentially over the next 20 years. Software accounts for 88% of the technology investments in buyout funds, a sector of mostly mature SaaS enterprise businesses considered significantly less volatile.

Web3 may be currently in shambles, but as history has shown with the dot-com boom of the early 2000s, it will persevere to prove a valuable investment. The innovations of this era will carry on for decades once the ugliness is behind us.

Powerhouses of varying industries, such as JPMorgan, Goldman Sachs, Google and Disney, are exploring how web3 will influence their businesses and how they interact with their customers. Goldman Sachs recently used its tokenization platform to arrange a €100 million bond sale between the European Investment Bank and two others, settling the sale in 60 seconds as opposed to the typical five days.

Blockchains, tokens, smart contracts and other web3 technologies will even affect how private equity firms invest and operate.

Private investors put $20-30 billion into web3-related companies last year, and even more went into internal investments made by corporations and financial institutions not even included in this number.

At first, web3 was dominated by early-stage investors, but has transitioned to later-stage growth funds, crossover funds and even buyout funds. We’ve seen that those finding success in investing during this tumultuous time are carefully matching targets to their specific mandate and risk appetite, making sure to create alignment around these choices from the investment committee on down.

They are rapidly standing up teams to develop fluency in how web3 is likely to evolve over the next five to 10 years and networking across the ecosystem to tap or hire specialized expertise. And finally, they are combining depth in web3 with their existing sector expertise to ensure that they understand specific use cases in due diligence and derive the sharpest investment insights sub-sector by sub-sector.

Those who see the biggest gains in the aftermath of a crash are investors who can see through the dust to identify the companies with viable, scalable business models, those that are capable of generating cash sooner rather than later.

Another area for investment in the coming years is the great energy transition. Companies will need trillions to fund resources to help the transition from fossil-based systems to renewable sources such as wind, solar and lithium-ion batteries.

Between 2017 and the first half of 2022, according to PitchBook, around $160 billion of total reported value went into buyout and growth equity funds related to energy transition. The right investment play depends on a fund’s appetite for risk and capital intensity, as well as its ability to seek out a unique approach to creating value for the market. Think innovation.

Successfully underwriting risk in the energy space requires careful consideration for how and when technology, regulatory and political considerations can impact a target company. In 2022, the dial was turned up on pressure for private equity firms to decarbonize their portfolios.

Failing to prepare for mounting pressure in the future will pose a risk for GPs. Successful companies draw from this pressure to shield the company’s performance, or set it up for exit by embracing efforts for a cleaner future and less exposure to regulatory risk.

Another area for opportunity that has been relatively untapped thus far is retail investors. They account for half of the estimated $275-295 trillion of global AUM. Yet these same investors represent only 16% of AUM held by alternative investment funds.

Alternative asset managers seeking to sustain double-digit growth are now expressing interest in this market. Wealthy individuals are being drawn to alternative investments for new diversification options and better returns than they can get in the traditional markets for public equity and debt.

With changing regulations and innovative tools, such as Opto Investments and iCapital, now more and more people are gaining access to varying types of alternative investments.

The appeal lay in private equity’s historically superior returns (14% globally over the past 25 years vs. 7% for the MSCI World Index), plus the fact that true diversification in the public markets has become increasingly harder.

Bain & Company projects that institutional capital allocated to alternative investments will grow 8% annually over the next decade. Individual wealth invested in alternatives is expected to grow 12% annually over that same time period. Taken together, these sources would support 9% annual growth in AUM through 2032.

With our assessment of 2023, plus what we’ve seen historically, private equity is in a good position to outperform the public markets when it comes to a wide range of interest rate and economic conditions. With opportunity in web3 and the great energy transition, plus the building momentum in the retail market, now is a great time to invest.

Those who will succeed will not panic in fear of turmoil, but create thorough risk mitigation plans and draw from their vision and sector expertise.

They’ll take a fresh perspective on a portfolio company’s competitive position to determine how to leverage it. They’ll embrace multiple arbitrage and focus on improving operating leverage and generating organic growth. They’ll act now. Slowing down on investment opportunities will only make companies suffer after all is said and done.

So much is still unknown for what’s to come in the next few years, but you can put yourself in a strong position to build your wealth and see high returns with the right winning approach strategy.